Credit card debt Program Insurance coverage Proportion (DSCR) lending options are usually particular financial loans which can be usually used by buyers inside real-estate and also organizations. These kinds of lending options are usually exclusively organized to be able to prioritize the particular borrower’s revenue relative to their particular present credit card debt commitments. DSCR lending options are usually popular with people wanting to broaden their particular portfolios or perhaps control continuous jobs, while they offer capital good applicant’s cashflow as opposed to standard revenue records.

Comprehending the debt Program Insurance coverage Proportion (DSCR)

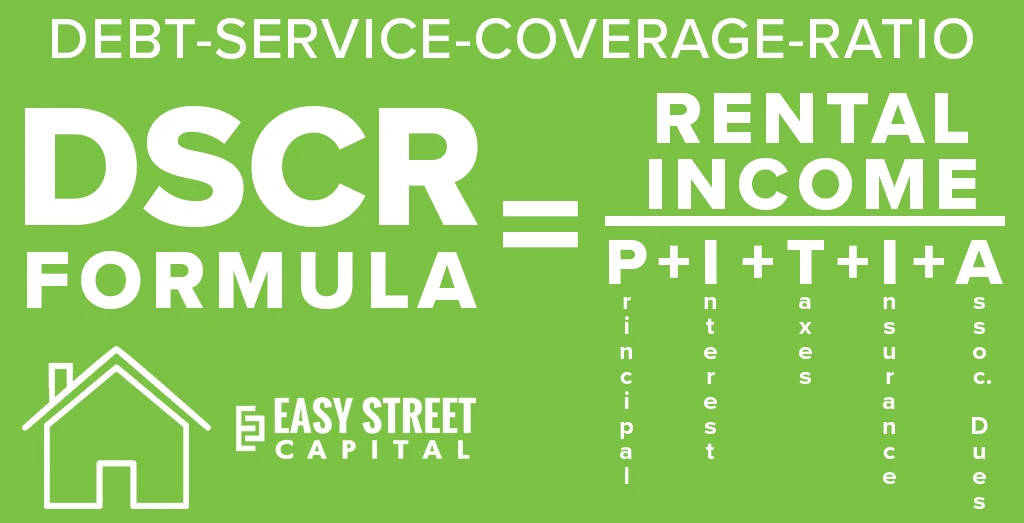

The debt Program Insurance coverage Proportion can be a economic metric employed by loan providers to be able to examine any borrower’s power to pay off credit card debt. It really is computed simply by splitting the particular borrower’s web running revenue simply by their particular overall credit card debt commitments. The effect, displayed being a proportion, gives perception in to the borrower’s economic well being. As an example, any DSCR of 1. twenty-five suggests the debtor provides 25% more cash as compared to their particular credit card debt specifications, which can be generally a satisfactory perimeter for most loan providers.

When it comes to DSCR lending options, loan providers assume the particular proportion being no less than 1. 0, and thus the particular revenue created is sufficient to pay the debt repayments. An increased DSCR proportion typically demonstrates far better economic stableness and also can result in a lot more positive bank loan phrases. Nonetheless, regarding consumers using a reduced DSCR, it is likely that being qualified to get a bank loan could be lowered except if the financial institution will take specific mitigations or maybe more interest levels.

Just how DSCR Lending options Perform

As opposed to standard lending options that What is Dscr Loan want substantial revenue records, DSCR lending options give attention to cashflow because the major determinant regarding eligibility. Loan providers examine any borrower’s DSCR proportion simply by studying economic assertions and also estimated revenue. This kind of overall flexibility rewards self-employed men and women and also real-estate buyers which may well not have got steady month to month revenue yet carry out create significant cashflow.

DSCR lending options tend to be utilized in owning a home, while they enable consumers to be able to power the particular local rental revenue from other attributes to be able to meet the criteria. The bucks movement coming from these kinds of attributes aids these illustrate an acceptable DSCR, permitting these to fund further assets. These kinds of lending options furthermore offer you competing interest levels, while they create a lesser chance regarding loan providers as a result of give attention to cashflow as opposed to job historical past or perhaps private revenue.

Features of DSCR Lending options

Overall flexibility inside Training course

DSCR lending options provide an choice for folks together with non-traditional revenue options, creating these available to be able to internet marketers and also real-estate buyers.

A smaller amount Records Necessary

Given that these kinds of lending options count on cashflow as opposed to revenue records, they will entail much less forms specifications, streamlining the particular loan application method.

Prospect of Increased Bank loan Sums

Consumers together with large DSCR proportions may well be eligible for greater bank loan sums, permitting them to fund considerable assets or perhaps large-scale jobs.

Interest Buyers

DSCR lending options are usually specifically useful regarding house buyers, while they are able to use local rental revenue to be able to meet the criteria and also probably broaden their particular portfolios.

Hazards Connected with DSCR Lending options

Although DSCR lending options offer you significant rewards, they may be not necessarily with out hazards. Consumers together with fluctuating revenue ranges might find that tough to keep up the particular DSCR proportion in the course of monetary downturns. In addition, due to the fact these kinds of lending options give attention to cashflow, there may be strain about consumers to keep up regular local rental or perhaps enterprise revenue. Any momentary drop inside revenue make a difference to the particular DSCR proportion, probably ultimately causing troubles inside bank loan repayment schedules.

Which Must look into any DSCR Bank loan?

DSCR lending options are usually suitable regarding real-estate buyers, self-employed men and women, and also companies. This kind of bank loan sort is great for those that create significant cashflow coming from assets yet may well not have got standard job revenue. Consumers inside these kinds of classes usually believe it is tough to be able to be eligible for standard lending options as a result of fluctuating revenue avenues, creating DSCR lending options a unique alternative.

Buyers trying to broaden their particular real-estate holdings or perhaps fund huge jobs usually count on DSCR lending options. These kinds of lending options enable them to be able to power their particular existing cashflow to be able to protected capital with out substantial revenue records. Regarding companies which prioritize progress, DSCR lending options give you a adaptable remedy in which aligns making use of their funds flow-centric economic users.

Bottom line

In conclusion, DSCR lending options certainly are a beneficial application regarding consumers which create steady cashflow coming from assets or perhaps organizations. Simply by emphasizing the debt program insurance coverage proportion, loan providers assess the borrower’s power to control credit card debt by means of revenue as opposed to standard job records. Together with adaptable training course standards and also much less records specifications, DSCR lending options are usually a nice-looking alternative regarding real-estate buyers and also self-employed men and women.

Although DSCR lending options offer you noteworthy rewards, they will have hazards, specifically inside fluctuating revenue cases. For anyone together with regular local rental revenue or perhaps steady cashflow, nonetheless, these kinds of lending options supply a sensible and also successful capital remedy.